Mortgage

buy / refinance / invest 4-10

Holistic Financial ConsultantTaxes • Mortgages • Money StrategyI help you move forward with clear numbers and calm, practical decisions.

2 languages

English + Spanish support

15 min

Free discovery call

L2 licensed

Mortgage agent in Ontario

Trusted, private guidance with practical next steps. Results vary by situation, but every plan starts with clarity.

Read client storiesChoose the pathway that fits your current priority.

buy / refinance / invest 4-10

10-year review / season prep / business

cash-flow / debt / systems

This review is most useful for clients with complex changes over the last few years, such as moves, job transitions, children, or shifting income.

We take a calm, step-by-step look at the previous decade only when relevant, then decide together whether this should be a priority now or later in your overall plan.

Not everyone needs this review first. We can help you choose the right starting point.

All work is private and confidential. The CRA pays any eligible refunds directly; our role is to help you see what's possible and walk through the process with calm, clear steps.

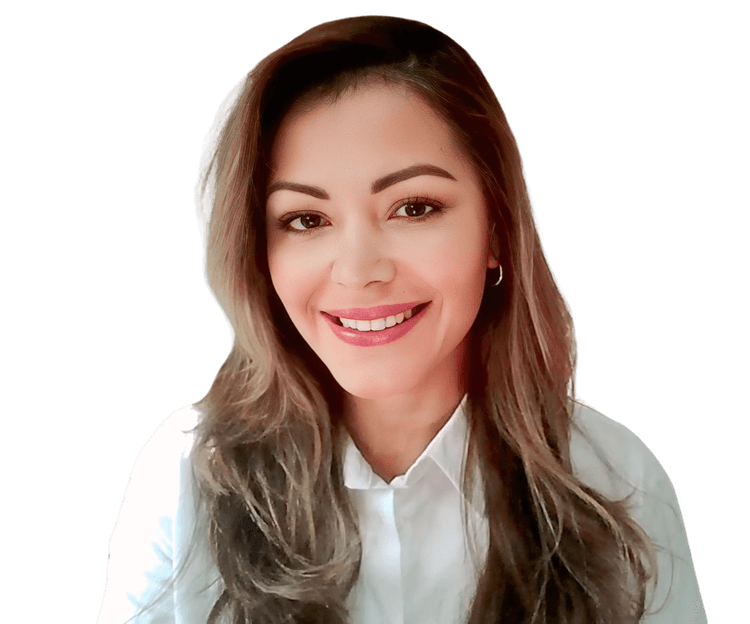

I'm Fanny Samaniego—a bilingual Mortgage Agent (Level 2), former CRA Income Tax Auditor, and holistic financial consultant based in Toronto. I help professional families, executives, and business owners make clear, values-aligned decisions across mortgages, tax rhythm, and everyday money strategy.

Ready for the full map?

Explore Full ServicesIntimate small-group circles led by Fanny and her team—like sitting around a kitchen table—where you can ask questions, get clear answers, and leave with next steps you’ll actually follow.

Simple calculators, checklists, and decision helpers to keep things moving—made to match how you actually follow through.

Short, practical reads on mortgages, money behavior, and tax basics—no jargon, just next steps.

Get monthly tips, checklists, and gentle reminders—bilingual and spam-free.

SubscribeNo pressure, no rush—just thoughtful guidance when it's right for you.

Start a ConversationHuman Design is optional—used only to personalize communication and pacing. It never replaces financial, tax, or legal fundamentals.